内容来源于

:复宏汉霖

2023年3月31日,复宏汉霖(2696.HK)发布2022年度业绩,

于业绩期内实现营业收入约人民币32.147亿元,较去年同期增长约91.1%

,主要来自商业化产品高速增长的销售收入及海外授权许可收入等。

截至目前,复宏汉霖已有5款产品在中国上市,1款产品在全球上市,18项适应症获批,加速拓展全球商业化版图。

同时,公司持续加码差异化创新,推动多元化创新管线进入新阶段,2022年度研发投入约人民币21.832亿元。

复宏汉霖董事长、执行董事兼首席执行官

张文杰先生表示

2022年是复宏汉霖极具里程碑意义的一年,我们在难中攀高,在稳中求进,高质量完成向Biopharma进化。其中,我们的业绩在疫情下逆势增长,营收突破30亿人民币,已上市的5款产品实现了销售快速放量,再次凸显了强大的商业化实力。此外,公司商务合作领跑全国,多款上市和在研产品达成海外授权, 首付款总额逾人民币15亿。在公司自研生物类似药和创新药的双驱动下,复宏汉霖正迈向更高层次的发展,并将持续提升市场竞争力,以期打造中国生物制药领导者形象,携手社会各方实现共同超越!

商业化迎里程碑突破,逐鹿全球步入新阶段

2022年,复宏汉霖不惧疫情影响,实现产品销售收入合计约人民币26.754亿 元,同比增长79.0%,创下历史新高,为公司研产销创新闭环注入强劲动能。截至2022年底,公司已建立起一支约1000人的覆盖商业化全流程的团队,全力布局并持续渗透中国市场,高效推进自营产品汉曲优 ® (曲妥珠单抗,欧洲商品名:Zercepac ® ,澳大利亚商品名:Tuzucip ® 和Trastucip ® )和H药 汉斯状 ® (斯鲁利单抗)的商业化落地,2022年分别获得销售收入人民币17.312及3.391亿元。此外,基于与合作伙伴约定的利润分成,公司就汉利康 ® (利妥昔单抗)、汉达远 ® (阿达木单抗)分别获得销售收入约人民币5.539亿元和0.512亿元。

拳头产品汉曲优 ® (曲妥珠单抗,欧洲商品名:Zercepac ® ,澳大利亚商品名:Tuzucip ® 和Trastucip ® )实现国内销售收入约人民币16.959亿元,较去年同期增长约95.4%,海外销售收入0.353亿元,海外授权许可及研发服务收入1.686亿元。凭借150mg/60mg双规格、不含防腐剂等差异化优势,汉曲优 ® 持续引领行业临床使用新规范,为不同体重区间的乳腺癌患者带来个性化、更经济的治疗方案。此外,公司协同Accord等海外商业合作伙伴,积极推动汉曲优 ® 的全球商业化进程,已实现在英国、法国、德国、瑞士、澳大利亚、芬兰、西班牙、新加坡、阿根廷、沙特阿拉伯等30多个国家获批上市。同时,汉曲优 ® 的上市许可申请已获得美国FDA受理,有望进一步覆盖欧美主流生物药市场。

公司首个创新产品H药 汉斯状 ® (斯鲁利单抗注射液)于2022年3月在国内成功上市,上市9个月累计销售额达3.391亿元,已获批MSI-H实体瘤、鳞状非小细胞肺癌(sqNSCLC)、广泛期小细胞肺癌(ES-SCLC)3项适应症。作为全球首个一线治疗小细胞肺癌的抗PD-1单抗,H药以15.8个月中位OS(总生存期)刷新全球SCLC免疫治疗记录,其国际多中心III期临床研究ASTRUM-005成功登上全球顶级期刊JAMA(影响因子157.3)。为覆盖更广泛的患者群体,公司同步推进H药的全球商业化布局,其治疗小细胞肺癌相继获得欧盟委员会(EC)和美国食药监局(FDA)的孤儿药资格认定。截至目前,H药 汉斯状 ® 一线治疗ES-SCLC的欧盟上市许可申请(MAA)已获得欧洲药品管理局(EMA)受理,公司亦计划于2024年在美国递交该产品的上市注册申请(BLA)。此外,H药一线治疗食管鳞状细胞癌(ESCC)的上市注册申请(NDA)也已获得中国国家药监局(NMPA)受理,相关研究ASTRUM-007结果于Nature Medicine(影响因子87.2)发表。

2022年,公司商务合作再创新高,获得海外授权许可及其他收入约人民币5.393亿元,同比增长188.3%。公司携手Organon、Abbott、Getz Pharma、Eurofarma和QY球友会医药等国际合作伙伴加速推进HLX11、HLX14、H药 汉斯状 ® 、汉曲优 ® 、汉利康 ® 、汉达远 ® 、汉贝泰 ® 等产品的出海进程,5项海外授权合作合计首付款超过15亿人民币,潜在交易金额高达14.46亿美元。其中,公司与Organon就两款在研生物类似药达成授权许可,据约定获得首付款7300万美元,并有望从交易中获得5.41亿美元的潜在收入,刷新了近5年来全球生物类似药对外授权单笔交易的最高记录;公司亦就H药 汉斯状 ® 与QY球友会医药达成战略合作,前瞻性布局美国生物医药市场,首付款达10亿人民币。

撬动国际临床数据,厚植差异化创新势能

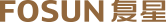

2022年,复宏汉霖持续横向拓宽和纵深化推进产品创新研发,加大以创新生物药为主导的研发管线投入,夯实抗体偶联药物等创新研发平台的建设,不断拓展产品疾病领域和双抗、ADC等新分子类型。公司同步在中国、美国、欧盟、澳大利亚等国家和地区开展30多项临床试验,全年新增获批16项临床试验,完成15项首例患者给药。

H药 汉斯状 ® 商业化快速落地的同时,公司积极拓展H药差异化优势,广泛覆盖肺癌和消化道肿瘤等高发大瘤种,于全球累计入组患者超3500人,多项研究取得重要突破并获国际权威学术平台认可。公司在2022年精益开展H药 汉斯状 ® 于全球更多区域和人群中的探索,H药用于治疗局限期小细胞肺癌(LS-SCLC)的国际多中心III期临床研究(ASTRUM-020)已完成美国首例患者给药。另一项H药对比一线标准治疗阿替利珠单抗用于ES-SCLC的头对头桥接试验也已在美国完成首例患者给药,以进一步支持H药在美国的上市申报。此外,公司以H药为基石,深化探索H药与汉贝泰 ® 、HLX07(抗EGFR单抗)、HLX26(抗LAG-3单抗)、HLX208(BRAF V600E小分子抑制剂)、HLX60(抗GARP单抗)等自有管线产品开展联合研究,以进一步放大抗肿瘤协同效应。

2022年,公司全力推动BRAF、LAG-3、TIGIT、4-1BB、GARP、OX40等多个肿瘤创新靶点产品的临床探索,并携手国际伙伴在全球范围积极布局,为产品未来的国际化注入更强动力。公司加速推进HLX11(帕妥珠单抗生物类似药)、HLX14(地舒单抗生物类似药)和HLX04-O(抗VEGF单抗)的国际多中心III期临床研究,并于中国、美国、欧盟、澳大利亚等国家和地区完成首例受试者给药。同时,公司亦通过许可项目引进的方式,持续丰富早期创新研发管线,分别与诺灵生物、Palleon和宜联生物达成战略合作,进一步筑牢公司在全球肿瘤治疗领域的竞争力。

提质增效护航大生产,一体化平台日臻完善

2022年,公司商业化产能翻倍至48,000升,徐汇、松江(一)、松江(二)三大生产基地形成协同和规模效应,2026年总产能有望达到144,000升。其中,松江基地(一)新增的24000L产能可全部应用于汉曲优 ® 的商业化生产,有力保障了市场的持续放量。2022年,松江基地(一)相继通过中国GMP、欧盟QP认证,并预计将于2023年完成FDA GMP的核查。松江基地(二)一期项目规划总产能为96,000升,首个工程批有望于2023年完成,以进一步满足公司中长期全球商业化生产需求。与此同时,复宏汉霖持续推动精益生产,提高生产效率,降低单位成本;不断加强关键物料及设备的本土化建设,包括深入探索大规模不锈钢生物反应器核心控制技术。

展望2023,复宏汉霖在不断夯实整体商业化实力的同时,将进一步聚焦早期创新研发,着力提高研发创新效率,积极优化三大生产基地的长期布局规划,向着研产销优势明显、发展健康可持续的Biopharma持续进化,不断超越,为全球患者带来更多更好的治疗方案。

关于复宏汉霖

复宏汉霖(2696.HK)是一家国际化的创新生物制药公司,致力于为全球患者提供可负担的高品质生物药,产品覆盖肿瘤、自身免疫疾病、眼科疾病等领域,已在中国上市5款产品,在国际上市1款产品,18项适应症获批,3个上市申请分别获中国药监局、美国FDA和欧盟EMA受理。自2010年成立以来,复宏汉霖已建成一体化生物制药平台,高效及创新的自主核心能力贯穿研发、生产及商业运营全产业链。公司已建立完善高效的全球创新中心,按照国际药品生产质量管理规范(GMP)标准进行生产和质量管控,不断夯实一体化综合生产平台,其中,上海徐汇基地已获得中国和欧盟GMP认证,松江基地(一)也已获得中国GMP认证。

复宏汉霖前瞻性布局了一个多元化、高质量的产品管线,涵盖20多种创新单克隆抗体,并全面推进基于自有抗PD-1单抗H药汉斯状 ® 的肿瘤免疫联合疗法。继国内首个生物类似药汉利康 ® (利妥昔单抗)、中国首个自主研发的中欧双批单抗药物汉曲优 ® (曲妥珠单抗,欧洲商品名:Zercepac ® ,澳大利亚商品名:Tuzucip ® 和Trastucip ® )、汉达远 ® (阿达木单抗)和汉贝泰 ® (贝伐珠单抗)相继获批上市,创新产品汉斯状 ® (斯鲁利单抗)已获批用于治疗微卫星高度不稳定(MSI-H)实体瘤、鳞状非小细胞肺癌和广泛期小细胞肺癌,成为全球首个获批一线治疗小细胞肺癌的抗PD-1单抗,其食管鳞状细胞癌适应症的上市注册申请也正在审评中。公司亦同步就16个产品在全球范围内开展30多项临床试验,对外授权全面覆盖欧美主流生物药市场和众多新兴市场。

Henlius 2022 Annual Results:

Significant Achievements in Commercialisation, Surged to RMB3.2 Billion in Revenues

Shanghai, China, March 31st, 2023 - Henlius(2696.HK)announced its 2022 annual results. In 2022, Henlius’ revenue reached about RMB3.2147 billion, representing an increase of 91.1% YoY, primarily due to sales revenue and licensing revenue generated by the successive commercialisation of various products. As of now, Henlius has launched 5 products in China, 1 product has been approved in overseas markets, and 18 indications were approved worldwide, continuing to expand its global presence. Meanwhile, the company stays focused on differentiated innovation to accelerate the development of products in its pipeline. In 2022, the company's R&D expenditure reached approximately RMB2.1832 billion.

Wenjie Zhang, Chairman, Executive Director and Chief Executive Officer of Henliu s, remarked: “2022 was a milestone for Henlius, as we strive for excellence in difficult times and seek progress in stability, achieving high-quality evolution towards Biopharma. Despite the pandemic, our performance has grown against the headwinds, with revenue surpassing RMB3 billion and sales of our 5 listed products increasing rapidly, once again demonstrating our strong commercial capabilities. In addition, our business collaborations lead the nation, with multiple products licensed out and an upfront payment totaling over RMB1.5 billion. Driven by our self-developed biosimilars and innovative products, we will continue to enhance our market competitiveness for a higher-level development, growing ourselves into a leader in China's biopharmaceutical industry, and working with all circles of society to achieve greater success.”

A major breakthrough in commercialisation, entering a new phase of global development

In 2022, Henlius has defied the impact of the epidemic and reached a sales revenue of approximately RMB2.6754 billion increased by 79.0% YoY, providing a strong impetus for R&D, manufacturing and commercialisation. By the end of December 2022, the company has established a team of over 1,000 professionals to speed up the entire commercialisation process, to build a business presence in the China market and drive the market penetration on trastuzumab HANQU YOU and serplulimab HA NSIZHUANG. In 2022, these two co re products of the company gained sales revenues of RMB1.7312 billion and RMB339.1 million respectively. In addition, the company received a profit-sharing of RMB553.9 million and RMB51.2 million for rituximab HANLIKANG and adalimumab HANDAYUAN respectively.

Henlius' core anti-tumour product, HANQUYOU (trastuzumab, trade name in Europe: Zercepac ® , trade name in Australia: Tuzucip ® and Trastucip ® ), achieved a domestic sales revenue of RMB1.6959 billion, representing an increase of 95.4% YoY, overseas licensing and R&D services revenue, and sales revenue recorded RMB35.3 million andRM B168.6 million, respectively. The 150mg/60mg dual dosage and preservative-free formulation of HANQUYOU sets it apart, leading clinical practices and providing a personalized and cost-effective treatment option for breast cancer patients of any weight. On the other hand, in collaboration with Accord and other overseas commercial partners, Henlius has been actively promoting the global commercialisation of HANQUYOU, resulting in its approval in more than 30 countries, including the UK, France, Germany, Switzerland, Australia, Finland, Spain, Singapore, Argentina and Saudi Arabia. Notably, the Biologics License Application (BLA) for HANQUYOU has been accepted by the U.S. Food and Drug Administration (FDA), which will further expand the product’s footprint in major markets of biologics in the U.S. and Europe.

The company's first innovative product, HANSIZHUANG (serplulimab), was launched in China in March 2022, with total sales revenue of RMB339.1 million in 9 months after launch and has been approved for 3 indications including MSI-H solid tumour, squamous non-small cell lung cancer (sqNSCLC) and extensive stage small cell lung cancer (ES-SCLC) so far. As the world's first anti-PD-1 monoclonal antibody (mAb) for the first-line treatment of small cell lung cancer, HANSIZHUANG set a record for SCLC immunotherapy with a median OS (overall survival) of 15.8 months, and its international multi-centre phase 3 clinical study ASTRUM-005 was published in the top medical journal JAMA (impact factor 157.3). The company has been pushing forward the global commercialisation of HANSIZHUANG to bring benefits to more patients and it was granted orphan drug designations by the European Commission (EC) and the U.S. FDA for the treatment of small cell lung cancer. As of now, the European Medicines Agency (EMA) has validated the Marketing Authorization Application(MAA) for HANSIZHUANG for the first-line treatment of ES-SCLC. Henlius also plans to submit a BLA for HANSIZHUANG in the U.S. in 2024. In addition, a New Drug application (NDA) for HANSIZHUANG for the first-line treatment of esophageal squamous cell carcinoma (ESCC) has been accepted by the NMPA in China, and the results of the study ASTRUM-007 were published in Nature Medicine (impact factor 87.2).

In 2022, the company made a new high in business collaboration and obtained overseas licensing and other revenue of approximately RMB539.3 million,re presenting an increase of 188.3% YoY. The company joined hands with international partners such as Organon, Abbott, Getz Pharma, Eurofarma and Fosun Pharma to accelerate overseas commercialisation of products such as HANSIZHUNAG, HANQUYOU, HANLIKANG, HANDAYUAN, HANBEITAI, HLX11, HLX14, etc. The upfront payment for overseas licensing revenues in 2022 totaled RMB1.5 billion, with a potential transaction amount of up to US$1.446 billion. Among which, the company sealed a deal with Organon for two biosimilars in development and is expected to receive up to a total of US$541 million, including an upfront payment of US$73 million, which marks the largest biosimilar licensing deal in the past five years. The company also entered into an exclusive license agreement with Fosun Pharma for commercialisation of HANSIZHUNAG in the U.S. with RMB1 billion of upfront payment, breaking into the U.S. biopharma market.

Enable differentiated innovation with global clinical data

In 2022, Henlius continued to broaden and deepen product innovation, commit greater resources to R&D pipeline with innovation product as a core, and consolidate the construction of R&D platforms such as antibody-drug conjugates (ADC) platforms. The pipeline cuts across a wider range of therapeutic areas and molecule types including bispecific antibodies and ADCs. The company initiated more than 30 clinical trials in China, the U.S., the EU, Australia and other countries and regions, with 16 new clinical trials approved and 15 first patient dosing completed in the year.

Along with the rapid commercialisation of HANSIZHUANG, the company is actively expanding its differentiation advantages to cover a wide range of high-incidence tumour types, including lung cancer and gastrointestinal cancer, and has enrolled more than 3,500 patients worldwide. It made breakthroughs and won recognitions from global academics. In 2022, Henlius explored more on HANSIZHUANG in wider population and more regions across the world. The first patient has been dosed in an international multi-centre phase 3 clinical trial (ASTRUM-020) of HANSIZHUANG in patients with limited-stage small cell lung cancer (LS-SCLC) in the U.S. Another patient has also been dosed in a head-to-head bridging trial of HANSIZHUANG versus first-line standard of care atezolizumab for ES-SCLC in the U.S, which propels the product towards U.S. market approval further. In addition, the company continues to explore the combination therapies between HANSIZHUANG and self-developed products such as HANBEITAI, HLX07 (anti-EGFR mAb), HLX26 (anti-LAG-3 mAb), HLX208 (BRAF V600E small molecule inhibitor) and HLX60 (anti-GARP mAb) to further maximize the anti-tumour synergy effect.

In 2022, Henlius has been unlocking the potential of the candidate targets including BRAF, LAG-3, TIGIT, 4-1BB, GARP and OX40, and joined forces with global partners to build global presence and open more markets. The company accelerated the international multi-centre Phase 3 clinical studies of HLX11(biosimilar to Pertuzumab), HLX14(biosimilar to Denosumab) and HLX04-O (anti-VEGF mAb), and completed the first-patient dosings in China, the U.S., the EU, Australia and other countries and regions. The company also enriched its early-stage pipeline by licensing-in, entering into strategic collaborations with Novacyte Therapeutics Biomedical Technology, Palleon and MediLink Therapeutics to further strengthen competitiveness in the global oncology therapeutics.

Enhance quality and efficiency to improve the integrated production platform

In 2022, the company's commercial production capacity doubled to 48,000 litres. The three production facilities, Xuhui Facility, Songjiang First Plant and Songjiang Second Plant, can altogether reach a larger operational scale with the total commercial production capacity expected to reach 144,000 litres in 2026. In 2022, Songjiang First Plant was put into commercial operation and its 24,000 litres can be fully used for the commercial production of HANQUYOU, which offered a strong support for its market expansion. In 2022, Songjiang First Plant obtained China GMP and EU Qualified Person (QP) certification and is expected to receive FDA GMP inspection in 2023. To secure more commercial production in the long run, the construction of Songjiang Second Plant is underway, with its first stage well on track and the first engineering run to be completed in 2023. Moreover, Henlius continues to promote lean manufacturing to improve production efficiency, drive cost reduction and reinforce the localization of key materials and equipment, by for example exploring the control system for large-scale stainless steel bioreactors.

Looking ahead, Henlius will continue to bolster up its commercialisation, keep improving the efficiency of innovation, and optimize the long-term planning of three manufacturing facilities to evolve towards a sustainable Biopharma with sharpened edges in R&D, manufacturing and commercialisation to bring more and better treatment options to patients worldwide.

About Henlius

Henlius (2696.HK) is a global biopharmaceutical company with the vision to offer high-quality, affordable, and innovative biologic medicines for patients worldwide with a focus on oncology, autoimmune diseases, and ophthalmic diseases. Up to date, 5 products have been launched in China, 1 has been approved for marketing in overseas markets, 18 indications are approved worldwide, and 3 marketing applications have been accepted for review in China, the U.S., and the EU, respectively. Since its inception in 2010, Henlius has built an integrated biopharmaceutical platform with core capabilities of high-efficiency and innovation embedded throughout the whole product life cycle including R&D, manufacturing and commercialisation. It has established global innovation centers and Shanghai-based manufacturing facilities in line with global Good Manufacturing Practice (GMP), including Xuhui Plant certificated by China and the EU GMP and Songjiang First Plant certificated by China GMP.

Henlius has pro-actively built a diversified and high-quality product pipeline covering over 20 innovative monoclonal antibodies (mAbs) and has continued to explore immuno-oncology combination therapies with proprietary HANSIZHUANG (anti-PD-1 mAb) as backbone. Apart from the launched products HANLIKANG (rituximab), the first China-developed biosimilar, HANQUYOU (trastuzumab for injection, trade name in Europe: Zercepac ® ; trade names in Australia: Tuzucip ® and Trastucip ® , the first China-developed mAb biosimilar approved both in China and Europe, HANDAYUAN (adalimumab) and HANBEITAI (bevacizumab), the innovative product HANSIZHUANG has been approved by the NMPA for the treatment of MSI-H solid tumors, squamous non-small cell lung cancer (sqNSCLC) and extensive-stage small cell lung cancer (ES-SCLC), making it the world’s first anti-PD-1 mAb for the first-line treatment of SCLC. Its NDA for the treatment of esophageal squamous cell carcinoma (ESCC) is under review. What's more, Henlius has conducted over 30 clinical studies for 16 products, expanding its presence in major markets as well as emerging markets.

//////////

扫一扫